DraftKings Insiders Sold Nearly $206M in Stock This Year

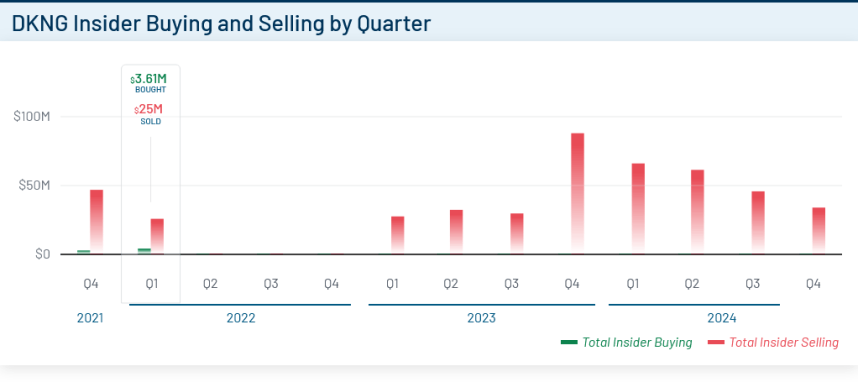

Unless new filings appear in the coming days, insiders of DraftKings (NASDAQ: DKNG) seem to have sold almost $206 million in shares of the gaming firm in 2024 as the stock recorded a performance that lagged behind the market.

After December stock sales by Chief Legal Officer R. Stanton Dodge and co-founder Paul Liberman exceeding $30 million, DraftKings insiders sold off $205.54 million of the gaming firm's equity in 2024, as reported by MarketBeat data, continuing a trend criticized by retail investors.

Compounding market participants' aversion to insider selling at DraftKings is the reality that top executives at the sportsbook company are not purchasing any shares. Among the 20 insider transactions reported by MarketBeat this year, which include actions by co-founders Liberman and CEO Jason Robins, all transactions are sales, with no purchases recorded.

The “upside” is that insider selling at DraftKings decreased as 2024 progressed. After reaching around $66 million in the first quarter, that amount decreased to $61 million during the April to June timeframe. It decreased to $45 million in the third quarter, then declined to $34 million in the last three months of the year.

DraftKings Performance Intensifies Insider Selling

The ongoing trend of insider selling at DraftKings occurred amid lackluster returns for investors. The gaming company's shares increased by only 5.53% this year.

That performance not only fell well short of the returns of the Nasdaq 100, S&P Select Sector Consumer Discretionary, and S&P 500 indexes — all of which increased by over 25% this year — but it also significantly underperformed against competitor Flutter Entertainment (NYSE: FLUT). The parent organization of FanDuel — the closest rival to DraftKings — jumped 44.39% in 2024.

Potentially complicating the situation for DraftKings shareholders is the reality that Flutter insiders rarely sell their shares. In the last three months, there have been no insider transactions—purchases or sales—at the Irish gaming firm.

In September, Flutter revealed a $5 billion share buyback program, surpassing the $1 billion repurchase plan announced by DraftKings in August.

Insider Selling Minimal at Other DraftKings Competitors, as Well

The insider selling at DraftKings is notable since similar activity at competing iGaming/online sports betting companies has been minimal this year, even when Flutter is not considered.

For instance, insider selling at Caesars Entertainment (NASDAQ: CZR) totaled under $350,000 in the past year, and during the first two quarters of 2024, top executives at the Caesars Sportsbook parent company purchased much more stock than they disposed of.

At Penn Entertainment (NASDAQ: PENN), the parent company of ESPN Bet, insiders purchased $2.61 million in shares over the last year, while sales amounted to only $126,578, as per MarketBeat data. In the context of transaction volume, purchases surpassed sales at Penn by a ratio of 4 to 1.