Macau Casinos Start 2025 Slowly, January Gaming Revenue Totals Less Than $2.3B

Macau casinos started the year sluggishly, with January gaming revenue being weak.

The Gaming Inspection and Coordination Bureau of Macau states that the gross gaming revenue (GGR) for January reached MOP18.25 billion (US$2.27 billion), reflecting a nearly 6% decline compared to the previous year. The January figure indicated a 0.3% increase from December.

The gentleness of January was somewhat anticipated, although the drop was greater than what analysts had predicted. JP Morgan projected a year-over-year GGR decline of as much as 4%, but the actual decrease was 5.6%.

Experts indicated that January 2024 offers a tough benchmark for January 2025, as elevated VIP baccarat volumes and robust hold rates led to a strong initial month last year. Market analysts noted a decrease in activity in the high-roller areas and a return to normal patterns in households last month.

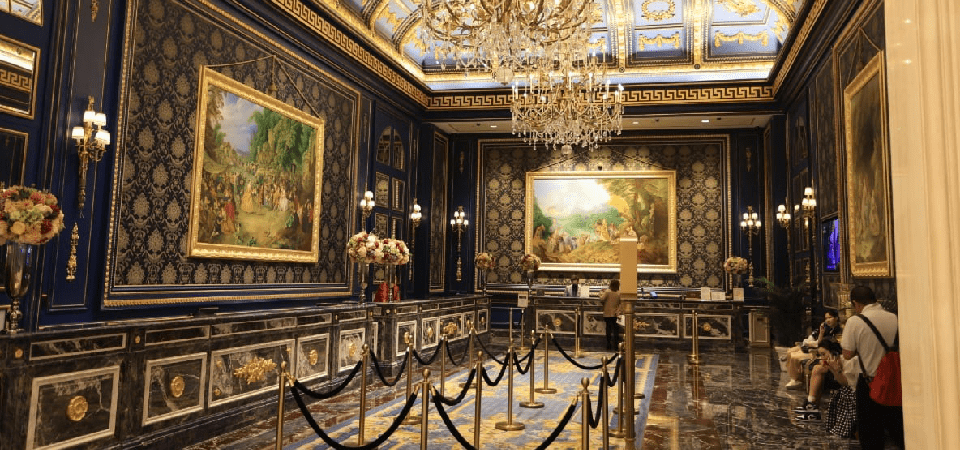

Macau hosts numerous casinos operated by six gaming companies — Sands, Galaxy, Wynn, MGM, Melco, and SJM. Macau, a Special Administrative Region of China, is the sole area under the People's Republic's authority where slot machines and table games are permitted.

A state-operated traditional lottery and sports lottery exist on the mainland.

2025 Lunar New Year

Although January was slow, analysts believe that the chances are favorable for Macau's gaming sector to maintain its recovery in 2025. February will gain from the 2025 Chinese New Year, which started on Wednesday, January 29.

Known as the Spring Festival, the Chinese New Year marks the beginning of the lunisolar Chinese calendar and offers most employees a week of leave. The Chinese government has announced an eight-day holiday from January 28 to Tuesday, February 4.

2025 is the "Year of the Snake," the sixth in the 12-year sequence of animals featured in the Chinese zodiac. In Chinese symbolism, snakes are viewed as intelligent yet lacking scruples, meaning they have no moral restraint regarding actions that might limit certain behaviors.

Is it possible for Macau casinos to return to their 2019 performance levels?

The JP Morgan team noted a slow second half in January as numerous visitors likely remained on the mainland in ожидании of the New Year holiday.

"According to our checks, there was a very noticeable pre-holiday slowdown this year, with a lull in traffic particularly affecting large properties,” wrote JP Morgan analysts DS Kim, Mufan Shi, and Selina Li.

In 2024, Macau’s six casino operators generated approximately $28.3 billion in revenue from gamblers. The year signified the second year of recovery for the Chinese casino hub from the COVID-19 pandemic, which extended into late 2022 due to Chinese President Xi Jinping's continued enforcement of his contentious “zero-COVID” policy.

The 2024 count accounted for 77.5% of the 2019 GGR, which reached $36.3 billion.

JP Morgan predicts that February's GGR will increase by 3% to 5%, making the initial two months of 2025 relatively “flat” in comparison to 2024. The brokerage anticipates that full-year 2025 GGR will increase by approximately 5%, indicating a third consecutive year of recovery.

To recover the impressive 22.5%, Macau’s gaming operators must persist in increasing mass market attendance and gaming following the departure of many VIP junket groups in light of evolving regulations set by Xi. The JP Morgan team noted that January's GGR showed a recovery of “over 110%” in mass play, while VIP saw only 20% in comparison to pre-COVID figures.