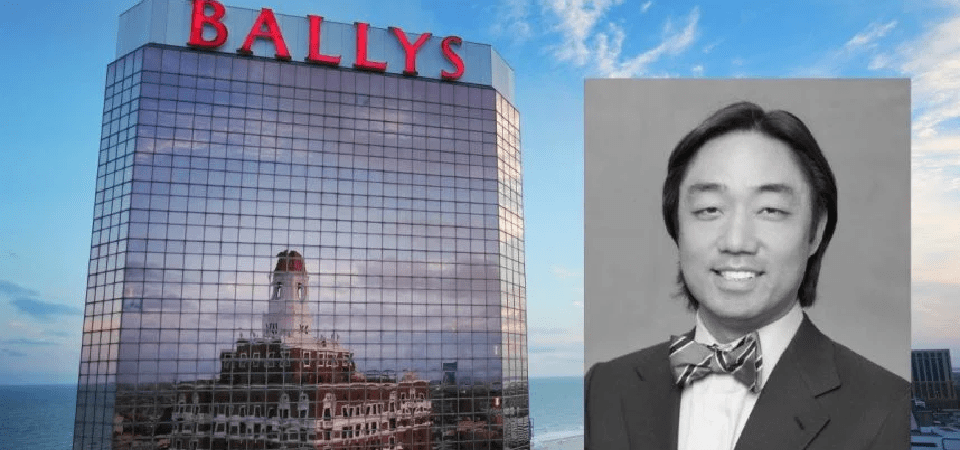

Standard General Bally’s Acquisition Unlikely to Face Antitrust Threats

Since the associated waiting period on that matter is scheduled to end at midnight Monday, it seems doubtful that federal regulators will examine Standard General's proposed $18.25 per share buyout of Bally's (NYSE: BALY) for antitrust violations.

According to CFTN, which cited two unnamed persons familiar with the situation, Standard General won't have to submit a second request to federal regulators because the Hart-Scott-Rodino (HSR) Act provisions related to the acquisition expire Monday night.

"Under the Hart-Scott-Rodino (HSR) Act, parties to certain large mergers and acquisitions must file premerger notification and wait for government review. The parties may not close their deal until the waiting period outlined in the HSR Act has passed, or the government has granted early termination of the waiting period,” according to the Federal Trade Commission (FTC).

In March, Standard General, the biggest hedge fund investor in Bally's, proposed a $15 buyout bid per share. In July, that was increased to $18.25 per share, which the local casino operator agreed to.

The size of Standard General Bally's purchase is insufficient to raise FTC concerns

Although it is a significant sum of money, the planned deal gives Bally's an enterprise value of $4.6 billion, which is not the price at which the FTC would consider requiring the buyer to alter the original agreement structure.

As the corporate sector grows increasingly concerned that the FTC has taken a tough stance against industry under Chairwoman Lina Khan, including actions to impede several large-scale mergers and acquisitions, rumors surfaced that Standard General is handling HSR regulations with skill.

For instance, the FTC filed a lawsuit to stop the $24.6 billion merger between Albertsons and Kroger, which is the biggest grocery store merger ever, on the grounds that it is anticompetitive. Several states have also stepped up to the plate and started looking into the merger through their own antitrust investigations.

According to reports, if Khan wins the November presidential election, some Democratic contributors have urged Vice President Kamala Harris to remove him. The Harris campaign has not made any public statements regarding the possibility of such a move.

The Standard General's Next Steps

The next step for Standard General is to deal with regulators in the states where Bally's runs land-based casinos, as federal antitrust issues don't seem to be a problem. Colorado, Delaware, Illinois, Indiana, Louisiana, Mississippi, Nevada, New Jersey, and Rhode Island, the home state of the gambling firm, are among them.

Since Standard General is a hedge fund and not Bally's direct rival, it is unlikely that the acquisition will result in a large loss of jobs or the closure of venues, which may be to the satisfaction of state gaming regulators. Similar to major gaming industry mergers, it doesn't seem likely that a wave of asset sales will be necessary.

By the first part of 2025, Standard General hopes to get the Bally's takeover finalized.